Mining Bitcoin, once a pursuit dominated by enthusiasts with basic computer setups, has evolved into a highly competitive industry requiring sophisticated hardware and strategic hosting solutions. For the uninitiated, diving into the world of Bitcoin mining may seem daunting. However, understanding the foundational steps and essential equipment opens the door to not only engaging with the cryptocurrency revolution but potentially reaping significant financial rewards.

At its core, Bitcoin mining involves solving complex mathematical puzzles to validate transactions on the blockchain, a decentralized ledger that secures the entire network. Miners are rewarded for their computational efforts with newly minted Bitcoins—a process that both secures and populates the blockchain. Unlike traditional investments, mining demands a deep interplay between technology, energy consumption, and market timing. Your setup—whether a singular mining rig or an extensive mining farm—will define your efficiency and profitability.

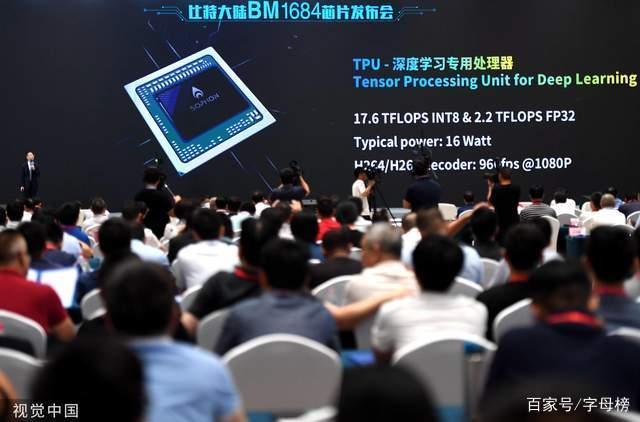

Choosing the right mining machine is paramount. The evolution from CPU mining to GPUs and now to Application-Specific Integrated Circuits (ASICs) underscores how specialized hardware dramatically boosts performance. ASIC miners, specifically designed for Bitcoin’s SHA-256 algorithm, offer unparalleled hashing power. Brands such as Bitmain and MicroBT lead the industry, providing machines that can hash at rates measured in terahashes per second. But with power comes complexity: electricity costs, cooling requirements, and hardware maintenance significantly impact your bottom line.

Equally crucial is mining machine hosting—a service where miners place their hardware in specialized data centers. Hosting mitigates common challenges like excessive heat, noise, and uptime reliability. For miners lacking adequate space or who face prohibitive electricity costs at home, hosting offers a practical alternative. These facilities often operate on renewable energy sources, reducing costs and environmental impact, while providing professional maintenance and network stability. Hosting transforms mining from a cumbersome hobby into a scalable enterprise.

The volatility of cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and even Dogecoin (DOG) introduces both opportunity and risk. While Bitcoin remains the flagship asset with the most extensive mining ecosystem, altcoins mined through GPU rigs—such as Ethereum and Dogecoin—still hold appeal, especially for newcomers exploring diversified portfolios. Ethereum’s transition towards proof of stake diminishes mining opportunities, yet the concept of hosting remains relevant, as miners pivot towards coins like Dogecoin or other emerging cryptocurrencies. Profitability thus hinges not just on hardware but also on market trends and coin-specific protocols.

When planning your mining endeavor, a comprehensive understanding of the exchange landscape is indispensable. After amassing mined coins, converting them to fiat currency or other cryptocurrencies usually involves exchanges like Coinbase, Binance, or Kraken. Market liquidity, transaction fees, and regulatory standing vary significantly between platforms. Savvy miners monitor price movements closely and execute trades to maximize returns, sometimes opting for decentralized exchanges to maintain privacy and reduce dependency on centralized entities.

The true advantage of mining today lies in diversification and integration. Some miners expand operations into hybrid setups—combining hosting services with direct machine ownership and leveraging multiple blockchain networks. Mining farms, with thousands of rigs in synchronized operation, exemplify this. These vast complexes not only benefit from economies of scale but also play a pivotal role in global network security. In contrast, individual miners might opt for remote hosting facilities to enjoy similar benefits without extensive capital investments.

Mining profitability calculators and analytics tools further refine a miner’s strategy. Real-time data on hash rate, power consumption, difficulty adjustments, and coin prices equip miners to adapt swiftly. Coupled with sound risk management and a long-term vision, these technological aids transform what might seem like a gamble into a calculated business endeavor. Indeed, the interplay between hardware innovation, energy sustainability, and financial acumen defines modern Bitcoin mining.

In conclusion, mining Bitcoin is no longer just plugging in a machine and watching coins roll in. It demands a holistic approach encompassing the procurement of cutting-edge mining rigs, strategic hosting decisions, and a keen eye on cryptocurrency markets and exchanges. Whether you aim to operate a personal rig hosting setup or aspire to manage a sprawling mining farm, success depends on marrying technology with market savvy. The digital gold rush continues, but only those who plan meticulously and act strategically will unlock its true potential.

Debunks myths, simplifies complex concepts! A surprisingly accessible guide, though “profitable” needs nuance. Practical, but DIY ethic essential. Heed warnings; mining’s volatile!