In the ever-evolving landscape of cryptocurrency mining, emerging technologies are reshaping the way miners approach their operations. As the digital assets market continues its dynamic flux, Canadian investors are positioning themselves strategically for 2025, capitalizing on the advancements in mining machinery and hosting solutions. The intersection of innovation and capital has breathed fresh life into this sector, with mining rigs becoming more efficient, powerful, and adaptive to the challenges posed by increasingly complex blockchains.

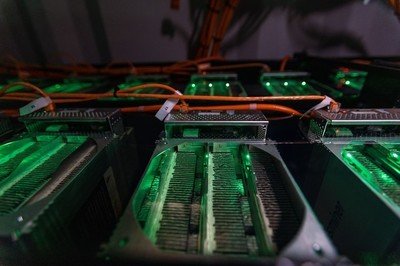

Bitcoin (BTC), often regarded as the bellwether of cryptocurrencies, remains a dominant force driving the demand for sophisticated mining equipment. The quest for higher hash rates and energy efficiency has accelerated research into novel ASIC designs and cooling mechanisms, reducing operational costs while maximizing output. This has profound implications for those running mining farms, where the scale of operations can turn marginal efficiencies into substantial profit margins. Canada’s stable energy infrastructure and government incentives further stimulate investment in these cutting-edge technologies, nurturing a fertile environment for miners to thrive.

Not to be overshadowed, Ethereum (ETH) continues to command attention despite its transition to proof-of-stake. While ETH mining rigs here may see a shift in demand, alternative proof-of-work coins and emerging Layer 2 tokens keep the mining machine market vibrant. Sophisticated miners optimize their fleets by incorporating multi-algorithm compatibility, enabling seamless pivoting across cryptocurrencies based on profitability. This technical agility is pivotal for mining farms that seek resiliency amid volatile exchange rates and shifting network difficulty levels.

Dogecoin (DOG), though initially a meme coin, has witnessed a surge in mining interest thanks to its Scrypt-based algorithm compatibility with Litecoin miners. This synergy expands the operational toolkit for miners invested in diverse portfolios. Canadian investors eye the hosting mining machine services—a model providing co-location facilities, maintenance, and turnkey operations—as a lucrative entry point. Hosting relieves individual miners from logistical challenges, letting them focus on strategy while experts manage the physical infrastructure. Such cloud mining paradigms blend traditional hosting with cutting-edge managerial software, enhancing transparency and scalability.

Exchanges, the hubs of trading activity for Bitcoin, Ethereum, Dogecoin, and beyond, play an indirect yet influential role in mining investment strategies. Fluctuations in exchange listings, regulatory developments, and liquidity transformations ripple through the mining ecosystem. Savvy investors monitor these market signals to calibrate their hardware acquisitions and hosting commitments. For instance, surging demand for ETH or sudden bull runs in BTC often propel miners to rapidly upgrade or expand their rigs, striving to capture increased rewards.

The year 2025 promises a landscape where blockchain innovation and mining technology coalesce more tightly than ever. The advent of AI-driven mining optimizers, integrated IoT sensors for predictive maintenance, and autonomous cooling systems herald a new era of operational excellence. Canadian investment communities are increasingly channeling funds into startups pioneering these breakthroughs, establishing the nation as a crucible for mining hardware innovation.

Moreover, the shift towards renewable energy sources in mining operations underscores the industry’s commitment to sustainability. Canadian mining outfits leverage hydroelectric power, drastically cutting emissions and operational costs. This green pivot will likely redefine competitive advantage in hosting mining machine services, as miners seek not just raw computational power but eco-friendly credentials that appeal to environmentally conscious investors and regulatory bodies alike.

In conclusion, the synergy of emerging technologies, diversified cryptocurrency markets, and robust hosting infrastructures creates an auspicious horizon for mining machinery investment in Canada come 2025. This convergence invites miners, investors, and technologists alike to rethink traditional paradigms, embracing agility, sustainability, and innovation as cornerstones of future success. Within this vibrant tableau, the pursuit of digital gold continues—infinitely dynamic, relentlessly adaptive, and profoundly transformative.

Mining machinery’s tech boom! Canadian investment eyes 2025. AI, automation reshape extraction. Efficiency gains, safety leaps, sustainability pushes. Risk versus reward: a deep dive.